Where Deals Get Done

CIX, powered by Elevate, is Canada’s largest startup awards program that brings together Canada’s most promising tech founders, global investors, and industry advisors to power new deals.

About CIX

Hosted in downtown Toronto from March 25-26, 2025, CIX, powered by Elevate, is an annual curation program and conference which showcases Canada’s most promising early stage and scaling startups.

In it’s 18th year, the 2025 CIX Summit will feature highlights such as curated startup presentations, keynotes and panels with industry leading executives, meeting exchanges with investors, as well as focused networking opportunities designed to foster new connections and provide forums for dialog. Due to the high concentration of curated startups, many of whom are selected as part of the coveted CIX Top 20 Early and Top 10 Growth Startup Awards Program, The CIX Summit has the highest concentration of startup execs and capital providers compared to other tech events.

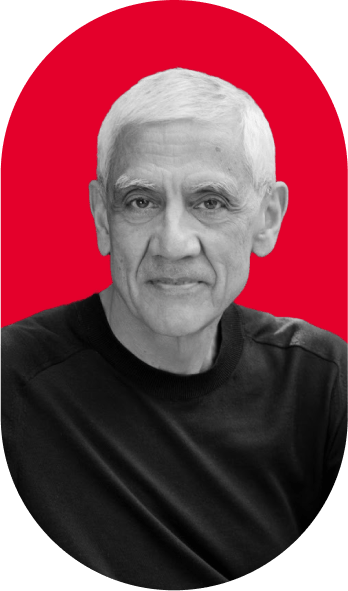

2024 Keynote Speaker

Vinod Khosla

Founder | Khosla Ventures

Vinod Khosla is an entrepreneur, investor, and technology fan. He is the founder of Khosla Ventures, focused on impactful technology investments in software, AI, robotics, 3D printing, healthcare and more. Mr. Khosla was a co-founder of Daisy systems and founding CEO of Sun Microsystems where he pioneered open systems and commercial RISC processors. One of Mr. Khosla’s greatest passions is being a mentor to entrepreneurs, assisting entrepreneurs and helping them build technology-based businesses. Mr. Khosla is driven by the desire to make a positive impact through using technology to reinvent societal infrastructure and multiply resources. He is also passionate about Social Entrepreneurship. Vinod holds a Bachelor of Technology in Electrical Engineering from IIT, New Delhi, a Master’s in Biomedical Engineering from Carnegie Mellon University and an MBA from the Stanford Graduate School of Business.